Is the term Art Trust Fund a new concept to you? If so, keep reading.

Every loving parent's desire is to be able to provide layers of protection for their kids whilst they are present and after they are long gone. Whether it is a trust fund, deeds to landed property, or board positions at conglomerates, it is no longer news that the wealthy love to set their children up for a successful future.

In today’s digest, we are discussing one of the more popular ways they do this: Art Trust Funds, and why you should set one up for your children.

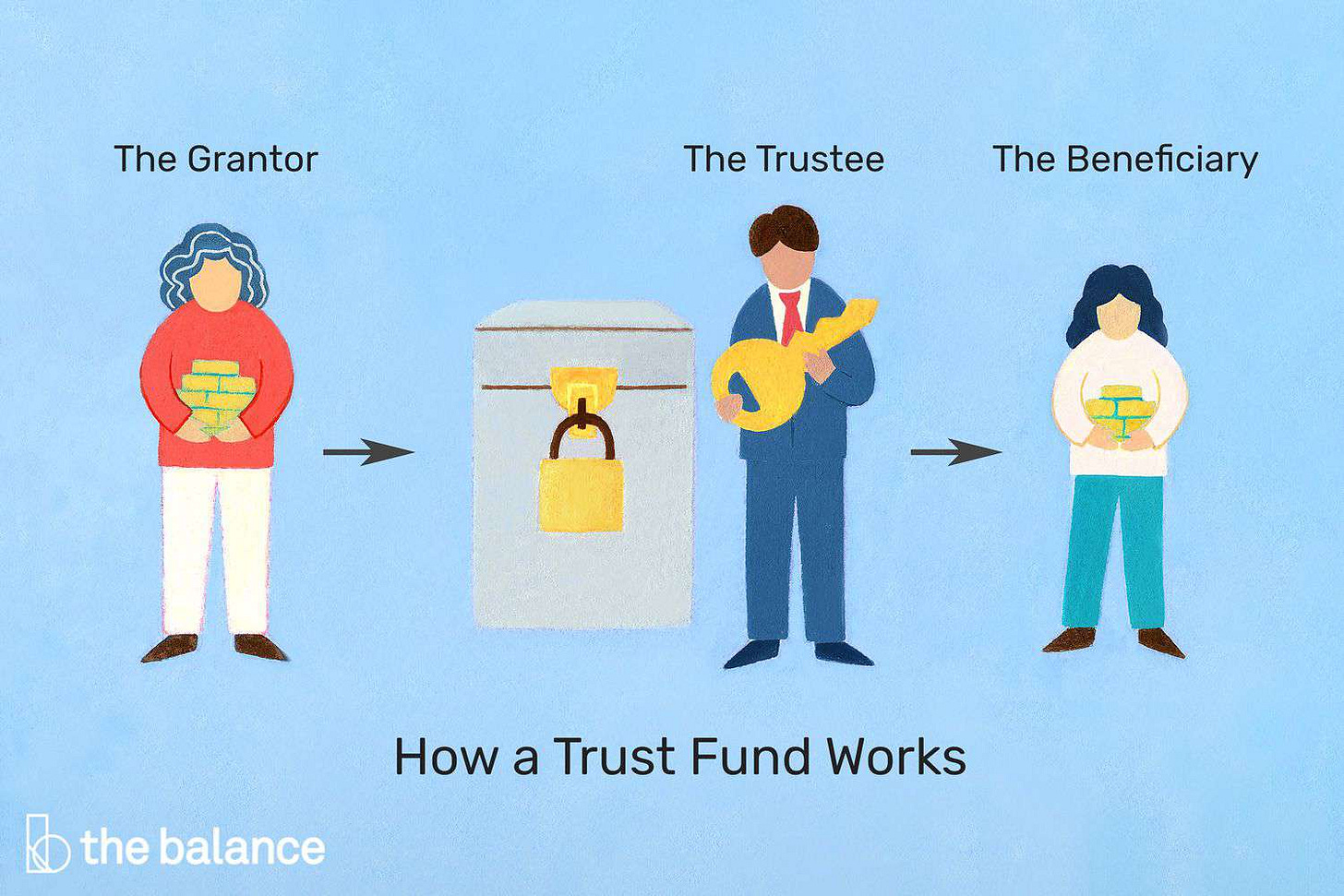

What is a Trust Fund?

A trust fund is a legal arrangement that holds assets for the benefit of another person, called The Beneficiary.

The person who sets up the trust fund is called The Grantor.

The grantor appoints a Trustee to manage the assets.

The Trustee is entrusted with the responsibility for investing the assets and distributing the income and principal to the beneficiary according to the terms of the trust.

In the family setting, parents or guardians typically set up trust funds for their children/warden with the sole purpose of creating financial stability and assistance in their future endeavours. The trust fund provides financial protection to the beneficiaries and is typically unblocked in the event of the death of the parent or guardian, or when they reach a certain age or milestone in life.

What is an Art Trust Fund? How does it Work?

An art trust fund is a type of trust fund that is used to hold and manage a collection of art. The art in the trust fund can be of any medium; paintings, sculptures, or photographs. The trust fund can be set up by an individual, a family, or a corporation. The purpose of an art trust fund can vary, but it is often used to preserve a collection of art for future generations, to support the arts, or to promote education about art.

The trustee of an art trust fund is responsible for managing the collection of art. Such responsibilities includes:

Acquiring new art: The trustee may be entrusted with acquiring new art for the collection. This can be done through purchase, donation, or exchange.

Conserving art: The trustee may be responsible for conserving the art in the collection. This includes tasks such as cleaning, framing, and repairing the art.

Exhibiting art: The trustee may be responsible for exhibiting the art in the collection. This can be done through public exhibitions, loans to other institutions, or educational programs.

Managing the financial affairs of the trust: The trustee is responsible for managing the financial affairs of the trust. This includes tasks such as investing the trust's assets, paying for insurance, and paying taxes.

Art trust funds can be a valuable way to preserve and promote art. They can also be a way to support the arts and to educate people about art. If you are interested in setting up an art trust fund, you should consult with an attorney to discuss the specific requirements and procedures involved.

Benefits of Art Trust Funds

Art trust funds are invaluable in so many ways. There are a myriad of benefits to setting up an art trust fund for your children. Four of the more popular benefits are highlighted as follows:

Tax Benefits: Undoubtedly, this is one of the most popular reasons why trust funds are generally set up. It highly depends on the structure of the trust and the assets it holds. We wrote a thing on art gifting tax implications and benefits in a previous Art Index Africa digest. However, it is advisable to also seek professional advice with your tax advisors as they are in a better position to provide specifics and implications about your situation.

Asset Protection: Art trust funds are an excellent way to protect your art collections from legal claims and creditors. This is because it is treated as a separate legal entity as such, assets in the trust are not considered to be part of your estate.

Supporting the Arts: An art trust fund can help to support the arts by providing funding for exhibitions, educational programs, and other initiatives.

Financial Security: Children born into wealth start on a solid financial footing because they are linked to trust funds set up in their names. An art trust fund will enable your children to inherit assets in the form of your art collection. As these assets are invested, it provides your children with a steady income stream that supports them financially and allows them to pursue their passions.

Encouragement of Artistic Pursuits: While this may be uncommon, it is however a great way to encourage artistic inclinations in your children. It communicates that you value and support their creativity. Creatively exposed children go on to be wildly successful in whatever chosen path they embark on in life.

How to Set-up an Art Trust Fund

Setting up an Art trust fund is no walk in the park. It can quickly become a complex legal agreement with many implications. As such, the involvement of multiple professionals is essential.

Here’s a step down guide on how to set one up:

Consult with a Financial Advisor: Financial advisors will provide deeper insight into your available options while recommending the best actions to take based on your circumstances.

Choose your Trustees: Trustees are responsible for managing the trust until the beneficiary comes of age. As such, they must be trustworthy and reliable. Ideally, choose someone who has proven their worth, such as a professional financial advisor. In addition, it is advisable to name a successor trustee. This is someone who can replace the selected trustee if they are unable to perform their duties. You may choose to name your art advisor as a successor trustee.

Decide on the Investment Amount for the Trust Fund: Decide how much money you intend to use to fund the trust and how often you will contribute. You can make a lump-sum contribution or make instalment payments.

Establish the Trust, Define its Purpose, and Name Beneficiaries: With the aid of an attorney and an art advisor, ensure that the trust complies with all legal requirements and clearly states its purpose. For example, if it is set up to support a child's artistic inclinations, then ensure that this is stated explicitly. Additionally, you could specify how the money should be used, such as for art lessons or obtaining a college art degree. Be sure to explicitly state the beneficiaries of the trust, such as your child or children. This ensures that what belongs to them rightfully gets to them.

Fund & Monitor the Trust: Now that the trust exists, fund it and monitor it for as long as you can to ensure it is properly managed and the money is used for the intended purposes.

If you would like to get started with setting an art trust fund for your children, ward, family, or business, get in touch: art@patronsmcaa.com.

Until next digest,

let’s get your art trust fund started.